Trusted by 50+ Lending Partners

5-Star Google Reviews

Satisfied Customers

Million In Funds Delivered

Why Choose Lyft Money?

Access the right funding to grow, invest, and manage cash flow with confidence. Whether you’re expanding, purchasing equipment, or need working capital, Lyft Money provides tailored finance solutions to support your business.

-

Finance for all business types

-

Flexible loan options

-

Fast approvals

-

Competitive rates from 6.24%.

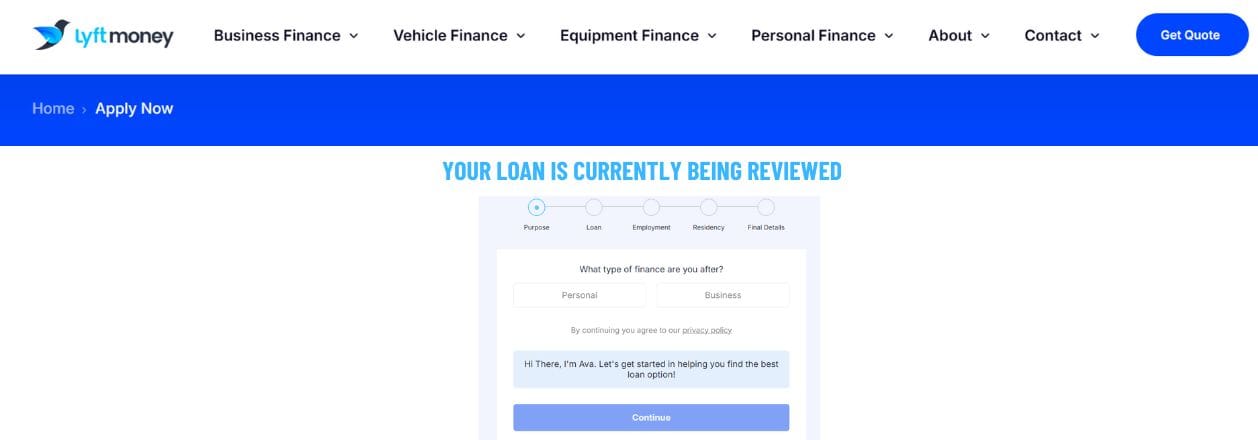

How It Works

How Lyft Money works

Getting finance through Lyft Money is simple. Apply online in minutes and get fast approval from real people who understand business. Once approved, access your funds and use them how and when you need — with no hidden fees or confusing terms.

Hyundai Sonata

2023 · 0 km · Automatic

Hyundai IONIQ5

2022 · 12,132 km · Automatic

Hyundai Santa FE

2023 · 62,137 km · Automatic

Interest Rate: 6.89%

Interest Rate: 5.99%

Interest Rate: 6.59%

Interest Rate: 6.99%

Interest Rate: 7.91%

Interest Rate: 6.45%

Your loan request is currently being reviewed

Your loan amount of:

has been approved!

Loan Comparison

Compare Multiple lenders with Lyft Money

Lender

Loan Amount

Loan Term

RATE

Testimonials

what people say about us

Jane Sonata

Travis Baker

Logan Diggs

Kate Morrison

Business Finance Solutions,

Australia Wide

At Lyft Money, we specialise in business and equipment finance tailored to your needs. Whether you’re expanding, upgrading, or managing cash flow, our team works with you every step of the way to secure the right finance solution—wherever you are in Australia.

Frequently asked questions

Find answers to commonly asked questions. If you still need help, feel free to contact us by clicking the blue button below.

Should I get car finance from a dealer, a bank, or a broker?

All three work, but costs and flexibility differ.

- Dealers = convenient but may include hidden fees.

- Banks = stable rates, but you do the shopping.

- Brokers (like us) = compare multiple lenders to find you the best deal.

Smart tip: Always check the comparison rate, not just the advertised interest rate.

What’s the benefit of getting pre-approved before shopping?

Pre-approval shows you your budget upfront and strengthens negotiations.

- You shop with confidence and speed up settlement.

- Example: With pre-approval for $40k, you know your limit and avoid pushy dealer finance.

What’s the difference between a secured and unsecured car loan?

A secured loan uses the car as collateral, giving lower rates.

- An unsecured loan doesn’t use the car as security, but interest rates are higher.

- Most Aussies use secured loans, but unsecured is an option for very old vehicles or personal reasons.

Why finance a car instead of paying cash?

Car finance helps you get on the road sooner and preserve savings.

- Businesses may also claim tax benefits.

- Example: Financing spreads a $40,000 ute over 5 years instead of draining savings upfront.

Do I need a deposit, or can I get 100% finance?

No-deposit car and truck loans are common in Australia.

- A deposit lowers repayments but isn’t always required.

- Many lenders advertise “no deposit? no problem.”

What documents will I need?

For most applications you’ll need a driver’s licence, two recent payslips or three months of bank statements, and proof of insurance.

- If you’re self-employed, you may be able to apply under a low-doc option.

- If low-doc isn’t suitable, lenders will generally require six months of bank statements, an accountant’s letter, or recent tax returns.

Having these ready upfront helps speed up approval.

Will applying hurt my credit score?

No, checking rates is usually a “soft check.”

- Only when you proceed with a specific lender is a “hard check” done, which can affect your score.

- This means you can shop around safely.