Fuel Your Business Growth

Business Finance

Smart finance solutions built for Australian businesses. Whether you’re growing, investing, or need short-term support, we help you access funding that fits your goals and keeps your business on the front foot.

5-Star Google Reviews

Satisfied Customers

Million In Funds Delivered

Business Finance Benefits

At Lyft Money, we’re committed to helping businesses unlock their full potential with tailored finance solutions. From flexible lines of credit to lump-sum loans and everything in between – we’ve got you covered.

-

Tailored options for different business stages

-

Fast approval and funding turnaround

-

Borrow from $10K up to $2M+

-

Minimal paperwork and hassle-free application

-

Suitable for ABN holders, sole traders, and companies

-

Options for unsecured and secured funding

-

Dedicated support from real finance experts

-

Nationwide access – no matter where you’re based

Why Choose Lyft Money?

Access the right funding to grow, invest, and manage cash flow with confidence. Whether you’re expanding, purchasing equipment, or need working capital, Lyft Money provides tailored finance solutions to support your business.

-

Finance for all business types

-

Flexible loan options

-

Fast approvals

-

Competitive rates from 6.24%.

Our Services

Business Finance

Finance That Grows With You

Get the right solution for your next move – from launch to expansion.

Access Funds When You Need

Capitalise on opportunities quickly with short approval times.

Tailored to Fit Your Business

We match you with lenders based on your profile.

No Red Tape

We cut through the complexity, making the process quick and easy.

Work With Specialists

Our brokers understand business, so you get advice that makes sense.

National Lender Panel

Choose from dozens of trusted lenders, banks, and fintechs across Australia.

What, When, Who?

What is Business Finance?

Business finance refers to the funding tools available to help businesses grow, manage cash flow, purchase assets, or handle everyday expenses. These can include lines of credit, term loans, invoice funding, or overdrafts.

It’s not just about borrowing money – it’s about backing your business with the right financial tools for growth and stability.

When Should You Use Business Finance?

Business finance can come in handy at key stages of your journey, including:

-

Launching a new product or service

-

Hiring staff or upgrading systems

-

Purchasing vehicles, equipment, or stock

-

Bridging short-term cash flow gaps

-

Investing in new premises or expansion

Who Is It Great For?

This solution is perfect for:

-

Small to medium businesses needing capital for growth

-

ABN holders and sole traders seeking flexibility

-

Construction, retail, logistics, medical, hospitality, and service industries

-

Start-ups, family businesses, or mature companies seeking expansion

Our Services

Lyft Money Business Finance

End-to-End Support

From application to settlement, we’re with you every step of the way.

Fast Turnaround Times

Smarter Matching

No Credit Hit

Pre-assessments don’t impact your score – explore your options freely.

Our Service

We’re here to make business finance simple, fast, and stress-free. Our experts work with you to understand your needs and find a solution that genuinely helps your business thrive.

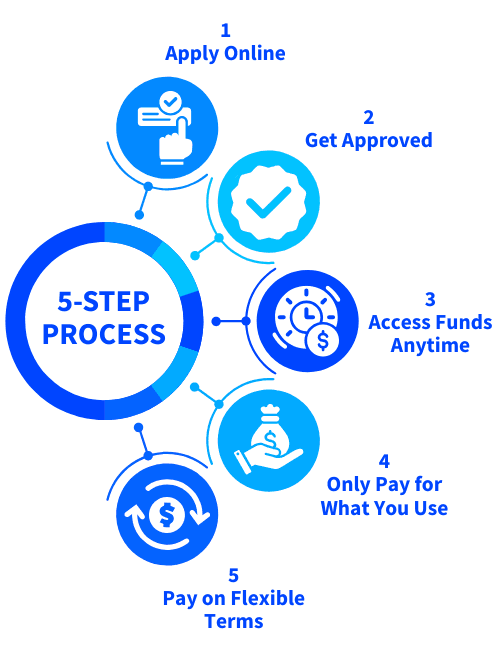

How it Works

Getting started with a business line of credit is quick, simple, and stress-free.

-

1. Apply Online

Submit a quick application - no piles of paperwork or long wait times.

-

2. Get Approved

We’ll assess your business and let you know your approved credit limit.

-

3. Access Funds Anytime

Draw down from your credit line whenever you need, no need to reapply.

-

4. Only Pay for What You Use

You’ll only be charged interest on the funds you actually draw.

-

5. Repay on Flexible Terms

We’ll work with your cash flow to structure repayments that suit your business.

Contact Us

Ready to Get Started?

Apply in minutes – no upfront costs, no obligation, and no impact on your credit score.

Just straight-up support, when you need it

Frequently asked questions

Find answers to commonly asked questions. If you still need help, feel free to contact us by clicking the blue button below.

1. What types of business finance do you offer?

We provide working capital loans, asset finance, business lines of credit, invoice funding, and more – tailored to your growth plans.

2. Is business finance suitable for startups?

Yes, some products are available for new businesses or ABNs under 12 months, especially if you have a strong personal credit file.

3. What can I use a business loan for?

Use it for stock, wages, renovations, equipment, marketing, or general cash flow needs – whatever your business requires.

4. Do I need security for business finance?

Not always. We offer both secured and unsecured options depending on the loan type, amount and lender requirements.

5. How much can I borrow?

Loan amounts range from $5,000 to several million, depending on your business’s turnover, credit profile, and the product selected.

6. Will applying hurt my credit score?

No, checking rates is usually a “soft check.”

- Only when you proceed with a specific lender is a “hard check” done, which can affect your score.

- This means you can shop around safely.