Heavy-Duty Finance for Heavy-Duty Machinery

Machinery Finance

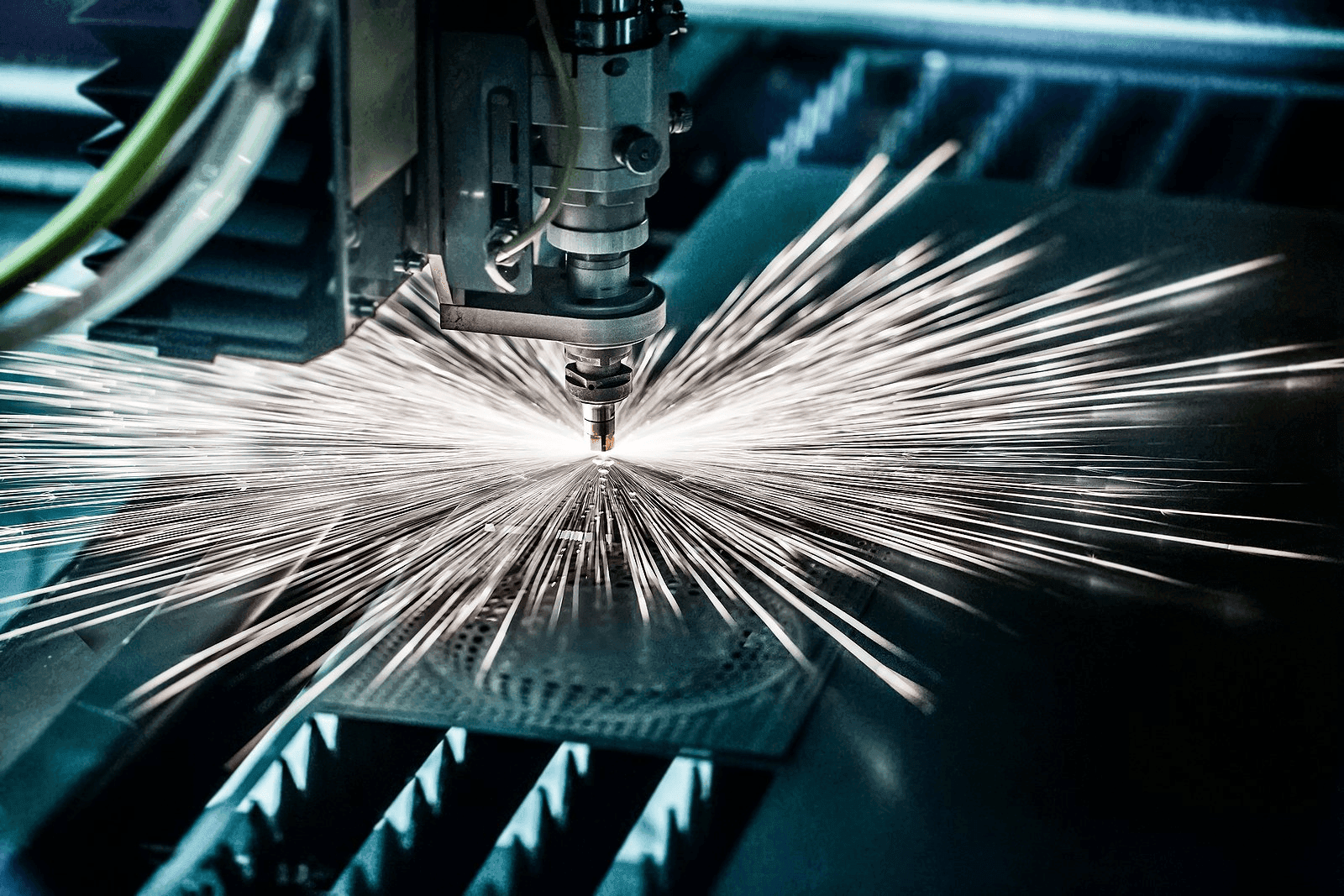

Power up your operations with flexible funding for machinery and heavy equipment. Whether you’re in construction, agriculture, mining, or manufacturing – we’ll help you finance the machinery you need to take on bigger jobs and boost productivity.

5-Star Google Reviews

Satisfied Customers

Million In Funds Delivered

Machinery Finance Benefits

At Lyft Money, we understand that big machines mean big opportunities – and big costs. Our machinery finance solutions are designed to help Australian businesses purchase, upgrade, or replace heavy machinery without the upfront hit.

-

Finance for new and used machinery

-

Chattel mortgage, lease, and hire purchase options

-

Low-doc and full-doc available

-

Funding for excavators, forklifts, loaders, CNCs, and more

-

Buy from dealer, auction, or private seller

-

Structured repayments to suit seasonal or project-based income

-

Flexible loan terms from 1 to 7 years

-

Pre-approvals available to move quickly on machinery deals

Why Choose Lyft Money?

Access the right funding to grow, invest, and manage cash flow with confidence. Whether you’re expanding, purchasing equipment, or need working capital, Lyft Money provides tailored finance solutions to support your business.

-

Finance for all business types

-

Flexible loan options

-

Fast approvals

-

Competitive rates from 5.99%.

Our Services

Machinery Finance

Get the Gear You Need

Low-Doc Solutions for Tradies & Operators

Been trading over 6–12 months? You may qualify without full financials.

Flexible Terms and Repayments

Buy New or Used

Fast Approvals When Timing Matters

Get pre-approved before you negotiate – and move fast when deals arise.

We Know the Industry

You’ll work with finance brokers who speak your language and understand your machinery needs.

What, When, Who?

What is Machinery Finance?

Machinery finance helps businesses acquire heavy or specialist equipment by spreading the cost over time. It includes funding options like chattel mortgages, leasing, and hire purchase – often using the machinery itself as security.

When Should You Use Machinery Finance?

Machinery finance is ideal when:

-

You’re taking on bigger jobs or growing your operation

-

Your current gear is outdated or breaking down

-

You want to preserve capital for other business costs

-

You need to act fast to secure a second-hand deal

-

You want to claim depreciation and interest (check with your accountant)

Who Is It Great For?

Machinery finance works for:

-

Earthmoving, excavation, and construction contractors

-

Manufacturing, fabrication, and engineering businesses

-

Agricultural operations and farming enterprises

-

Mining and industrial service providers

-

Trades and small operators scaling up

Our Services

Lyft Money Machinery Finance

Built for Big Jobs

Finance structured for the realities of heavy-duty business.

Access to National Lenders

We work with top equipment finance providers across Australia.

Buy With Confidence

Pre-approval gives you negotiating power and peace of mind.

Get Help From a Broker Who Gets It

We know equipment finance – and how to get your deal moving.

Our Service

Machinery finance is your gateway to bigger jobs, better results, and long-term growth. We help you fund the machines that drive your business forward – with speed, support, and smart solutions

Contact Us

Ready to Get Started?

Apply in minutes – no upfront costs, no obligation, and no impact on your credit score. Just straight-up support, when you need it

Testimonials

what people say about us

Jane Sonata

Travis Baker

Logan Diggs

Kate Morrison

Frequently asked questions

Find answers to commonly asked questions. If you still need help, feel free to contact us by clicking the blue button below.

1. What kinds of machinery can I finance?

Everything from excavators and bulldozers to CNC machines and farming gear – if it moves or produces, we can likely fund it.

2. Do I need to provide financials?

For larger loans, yes. But for smaller amounts, many lenders offer low-doc or no-doc options.

3. Is financing available for second-hand machinery?

Yes – provided the machinery is in good condition and fits within lender age restrictions.

4. Can I include delivery or installation costs?

Often, yes. We can bundle associated costs into your loan where permitted.

5. Are repayments fixed?

Yes – repayments are set at the start so you can budget with confidence.

6. Can I pay off my loan early?

Often yes, but some lenders charge early payout fees.

- We’ll find you a product that suits your future plans.

- Example: Some loans allow unlimited extra repayments without penalty.

7. What’s a balloon payment?

A lump sum due at the end of the loan to keep repayments lower.

- Example: $50,000 truck with 20% balloon = $10,000 due at term’s end.

- Works well if you plan to trade in or upgrade later.

8. Will applying hurt my credit score?

No, checking rates is usually a “soft check.”

- Only when you proceed with a specific lender is a “hard check” done, which can affect your score.

- This means you can shop around safely.